SERVICE

Global PPP

-

01

Index Group is engaged in planning social infrastructure development projects in emerging and developing countries and implementing infrastructure development through public-private partnerships (PPPs). Specifically, we identify projects suitable for PPPs through communication with foreign governments, analyze their marketability and risks, and then organize investors and general contractors to participate in the projects.

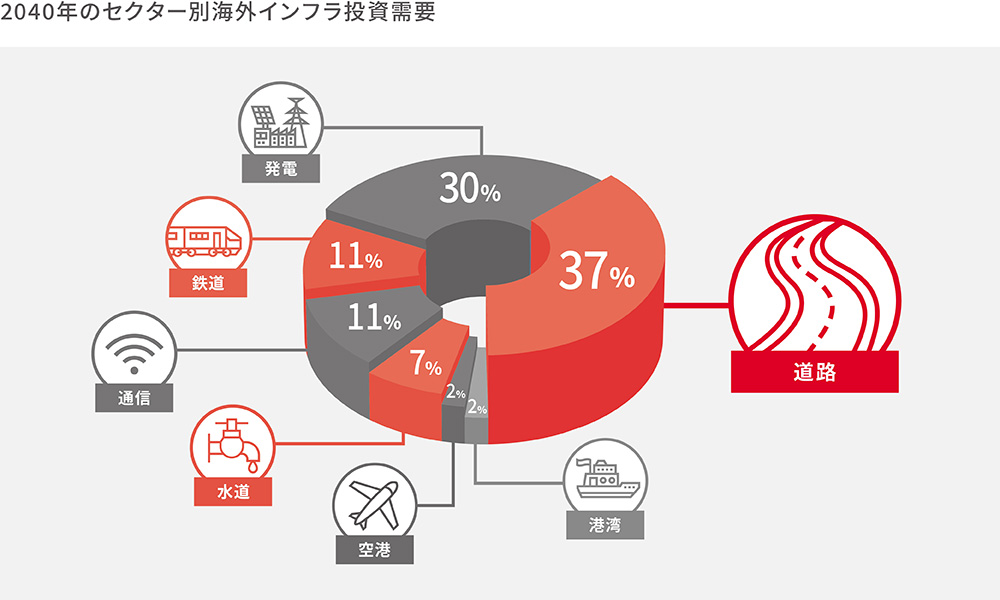

Currently, Index Group is focusing on concessions for existing toll roads (selling the right to operate infrastructure to the private sector for a certain period), but in the future we plan to work on PPPs for ports, railroads, and energy-related facilities in Southeast Asia, Africa, and North and South America.

In the past, when Japanese companies participated in overseas infrastructure construction, it was mainly through ODA (Official Development Assistance). Recently, however, many countries are reluctant to increase their debt, and infrastructure investment is shifting from ODA, which is government debt, to PPP, which assumes introduction of private funds. More and more countries are seeking the advanced technological capabilities of Japanese companies and the know-how of the private sector in fields such as service area management.

However, it is companies from Spain, France, Australia, and others that are winning PPP projects in transportation infrastructure around the world, and Japanese companies are not even in the top 20. Considering that PPP will become the mainstream for infrastructure investment in emerging and developing countries, it is more important than ever for Japanese companies to engage in PPP in order to prosper in the overseas markets.

-

02

Identifying Promising PPP Projects

When organizing PPP projects overseas, the first thing to do is to investigate whether there are suitable PPP projects in the country.

Countries usually have a list of infrastructure projects they plan to develop. This is commonly referred to as the "long list”. From this long list, we narrow down the list to the projects that are likely to be profitable and where the technology and know-how of Japanese companies can be utilized, and propose infrastructure development to the government of the country.

The key to success in overseas PPPs is to extract projects that are profitable and low risk. Highly profitable projects are usually awarded to national businesses in the country. The only way to get good quality projects, is to dig deep into the needs of the partner country and repeatedly make proposals that only we can make.

Index is currently conducting pre-feasibility studies (pre-FS) for toll road PPP projects in Ghana and Vietnam. These two projects have been selected by JICA (Japan International Cooperation Agency) as Preparatory Surveys (PPP infrastructure projects). Our ability to win these projects is a result of our good communication with the counterpart government and our high ability to make proposals.

-

03

Research and business development for commercialization

Projects selected from the long list are rigorously checked for marketability and risk through two stages of research: Pre-FS and FS (Feasibility Study).

Pre-FS is a preliminary study in which, in the case of toll roads, traffic volume and future demand trends are studied to determine what form of PPP is appropriate (Note 1). After that, if the project seems promising, it will proceed to FS. At this stage, in addition to more detailed demand surveys and risk analysis, we begin to create specific schemes, such as the formation of a corporate consortium and the capital structure of the SPC participating in the bidding.

There are various risks involved in overseas PPPs. For example, if an availability payment method is adopted, it is essential to identify possible risks and consider how to deal with them, such as whether the counterpart government will continue to pay, how to evaluate the validity of the payment, and how to prepare for the risk of non-payment.

In addition, during the pre-FS and FS, we always consider not only the business feasibility of the infrastructure project, but also whether the project will be beneficial to the country, the participating consortium, and the local community.

For example, in the toll road project in Ghana, we are planning to construct low-income housing and water supply and sewage systems as a supplementary project. Since there is a strong need for these infrastructures in Ghana, and Japanese companies are strong in the fields, we proposed the development of housing and water and sewage systems. This will be a plus for the people of Ghana.

-

04

Monitoring from the start of construction to completion

After successfully winning a PPP project in a bid, we conduct regular monitoring until completion. Unlike in Japan, we will be hiring a local construction company, so we will work with our local partners to check whether construction is being carried out according to design, and whether there are any delays in schedule or budget overruns.

-

05

Advisory services for private partners

As the domestic market shrinks, more and more Japanese companies are becoming interested in overseas PPPs. Many companies want to build plants and other facilities locally in the form of PPPs and participate as operators. As a pioneer in overseas PPPs, Index Group provides various consulting services to such companies, such as searching for the needs of the counterpart countries, researching demand, and comparing technologies with those of competitors, in preparation for the formation of future PPP projects.

Note 1: PPPs include concessions, in which the operating rights are sold to the private sector for a certain period; availability payments, in which the government pays a certain amount based on the performance of the private concession company; BTO (Build Transfer Operate), in which the private sector is responsible for construction, maintenance, and operation, and BOT (Build Operate Transfer), in which ownership is transferred to the public sector at the end of the contract period.

EXPERT

-

Airi IKEDO

Index Strategy Director and COO

Joined the company after working as an international sales manager at a firm specializing in water environment projects. Currently responsible for infrastructure PPP projects in countries such as Ghana and Vietnam. Leads project management with speed and drive, aiming to deliver optimal solutions by carefully considering the nature of each project and the roles and perspectives of all stakeholders involved.